The Power of Turnover Rate

To gauge the efficiency of your billing and collections process, you need to measure just one KPI – the turnover rate. This number reflects the average time it takes from when your firm completes the work for a client to when the payment is received. In other words, how long it takes for the firm to convert its work into cash.

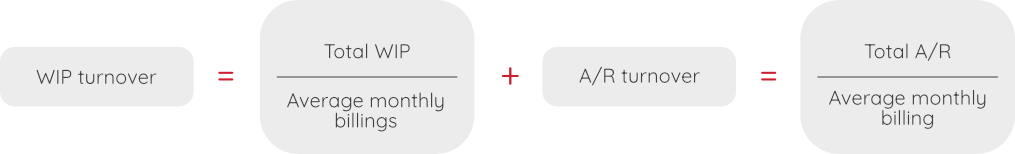

The turnover rate comprises two components: work-in-progress (WIP) turnover and accounts receivable (A/R) turnover. WIP turnover refers to the number of months it takes to bill for the work in progress, while A/R turnover represents the number of months it takes to receive payment.

Calculating the turnover rate is easy. You simply divide the total WIP and A/R by the average monthly billing to get the turnover rates for each component, and then add them together to get the total turnover rate:

The average turnover rate for law firms is 4.5 months, but a reasonable goal is to reduce it to 3.5 months. By reducing the turnover rate by one month, the firm can move forward 8.3% of its cash flow. Reducing the turnover rate also leads to a reduction in write-offs.

To improve any aspect of a firm’s performance, it’s essential to measure it. It’s also crucial to ensure that those KPIs are well-understood and discussed in management committee meetings to ensure that everyone is aligned with the firm’s goals and performance.

Motivating Partners

Once partners understand the value of this metric, breaking down the reporting by billing attorney will encourage timely billing and collections. It’s not unusual to see some significant variance by billing attorney. However, practice area should also be considered, as it can obviously affect turnover rate.

Don’t Have A/R

The most direct way to reduce turnover rate? Don’t have A/R!

We can start new clients on the right basis by requiring a trust deposit before completing file opening and allowing any work to commence. Take this approach one step further with evergreen trust deposits, requiring a certain balance to be maintained in the client’s trust account for work to continue.

Alternatively, use automatic electronic payments to immediately collect new billings. Auto pay is becoming common in consumer and small business practice areas: clients agree in the engagement letter to automatically pay bills via credit card or ACH when the bill is issued or a set number of days later, allowing time for review and discussion with the billing attorney if needed.

Automation

One of the biggest barriers to improving a firm’s turnover rate is having the resources to adequately tackle it. It’s a rare (or non-existent!) accounting department at a law firm that has a lot of excess time. The problem with many of these suggestions is that they take more time. Managing opening trust deposits, following up to maintain evergreen trust accounts, remembering to bill credit cards on file – done manually, these are challenging tasks.

The solution is to add automated workflows, removing the repetitive, time-intensive activities from the billing cycle. Nelson Hardiman, for example, has saved three days every month using BillingQ workflows.

You can then re-allocate staff time to more strategic activities.

Reminders

Professional, automatic A/R follow-up is the simplest and most direct way to reduce your A/R turnover rate. Sometimes, reluctant billing attorneys can be brought into the fold by creating an approval process for the outgoing emails.

Wondering if it will pay off? Lippes Mathias collected $150,000 in the first two months – “found money”

Track Over Time

Finally, evaluating the turnover rate over time will demonstrate the effectiveness of the firm’s efforts to improve its billing and collections process.

Learn more about automating billing workflows with BillingQ.

Author