Accepting online payments is now a normal course of business in legal. Addressing the compliance issues specific to law firms remain critical, but these capabilities are no longer specialized or rare. The new frontier is not in just accepting payments, but improving the process for the firm’s accounting department and clients.

We’ll break down the top two providers in legal, LawPay and ClientPay (which are owned by the same company), versus the up and coming PayQ.

Pricing

In the early days of law firms accepting online payments, the limited providers were able to charge premium rates. In markets outside of legal, flat-rate pricing is commonplace, and we’re now starting to see the same transparent approach in legal.

| LawPay / ClientPay | PayQ | |

|---|---|---|

| Visa, MasterCard and Discover |

2.99% processing + $0.30 per transaction; Card-based network fees "may apply" |

2.95% – no transaction fees |

| American Express |

3.90% processing + $0.30 per transaction; Card-based network fees "may apply" |

2.95% – no transaction fees |

| eCheck / ACH | 1% processing – no cap | $1 per transaction |

Many firms finding paying a percentage on eChecks to be unacceptable. Some firms split their online payments, moving eChecks/ACH to their bank for lower fees. The unfortunate consequence is a less intuitive experience for clients and the need to manage two payment streams in the accounting department. A better solution is reasonable pricing that brings credit card and eCheck processing together.

Accounting Capabilities

The cost savings is important. But the real advantage of a modern payments platform comes in streamlining the process for your accounting department.

| LawPay / ClientPay | PayQ | |

|---|---|---|

| Invoice matching | Limited ability | Payments are allocated to invoices line-by-line eliminating reconciliation hassles |

| Payment application | Entered manually for most systems | Payments are automatically recorded and applied in the firm’s billing system to specific invoices for integrated systems |

| Overpayments | Accounting must handle overpayments mistakenly made by clients | Overpayments are not allowed. Clients choose the bills to pay, entering partial payments if needed. |

| Credit card vs. eCheck | Focused on driving clients to pay via credit card | Equal treatment to credit cards and eCheck |

| Deposits | Separate deposits for credit cards and eCheck | Unified deposits |

| Deposit Clearing | Takes three days to clear | Clear in one day |

Client Experience

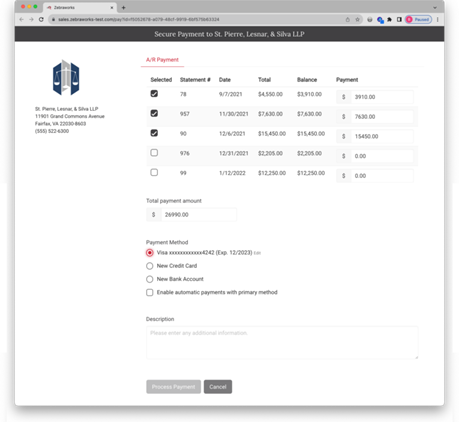

We’ve learned a very simple maxim in developing the next generation payments platform: if you make it easier for clients to pay, they will pay faster and more often.

| LawPay / ClientPay | PayQ | |

|---|---|---|

| Client account information | Often, clients must re-enter extensive contact and payment information | Payment information is automatically recalled, making the client experience swift and efficient |

| Client Portal | None | Simple and elegant user experience for clients to see their outstanding bills |

| Autopay | None | Easy autopay options |

| Evergreen Trusts | None | Automated workflows |

Bottom Line

In evaluating newer online payment options, law firms are uncovering “Found Money”:

- Firms no longer need to pay premium rates for legal-specific online payments: newer platforms like PayQ offer lower fees compared to traditional systems like LawPay or ClientPay.

- Simplified pricing for eCheck/ACH transactions ($1 per transaction with PayQ) offers significant savings over percentage-based processing fees.

- Modern systems streamline accounting while improving the client experience, resulting in faster payments.

Learn more about PayQ, the next generation law firm merchant account and our full legal Invoices-to-Cash solution BillingQ.

With PayQ, we "found money" that used to go directly to credit card companies.