Short answer: If you like making more money

No one likes paying credit card fees—particularly attorneys. One “solution” is to pass on the fee to your clients. That’s better than not accepting online payments at all, but it’s also an excellent way to make sure you don’t actually get the benefits of doing so.

Here, however, is the irony: not only will your client experience be better, but it’s also more profitable to accept credit cards.

The challenges of growing A/R aren’t going away: according to Citi Hildebrand, law firm A/R increased by 9.4% in 2023, on top of an increase of 10.4% in 2022.

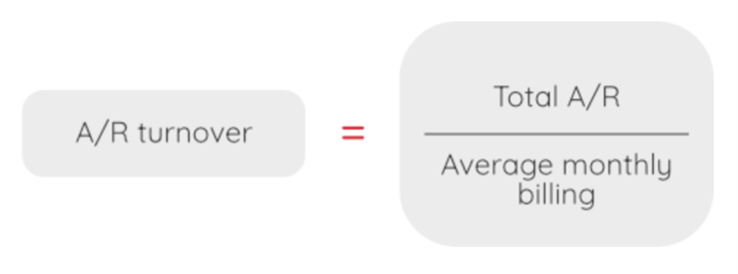

A/R Turnover

A/R turnover is the standard way to track collections performance. It is a simple calculation: how many months of billing do you have in A/R? If you bill $1M per month and have $3.5M in A/R, then your A/R turnover is 3.5 months. That’s the average for law firms.

Firms’ clients who pay online do so about one-third faster. That’s a reduction of over a month in A/R turnover, which means, in our example, if all paid online, of moving $1M of cash flow into the current year.

Collection Realization

Another critical measure is collection realization: what percentage of your billing do you collect? Collection realization rates have also faced increased pressure recently, now averaging 89%.

The faster you collect A/R, the lower your write-offs and therefore the higher your realization rate. We consistently see a higher realization rate of 2.5% to 4.5% within a firm’s client base that regularly uses online payments.

Like most things in billing and collections, there is variation by size of firm and practice areas, but we see an average of 28% of online payments through ACH. Although first-generation legal merchant accounts charge a percentage fee with a cap, these days you should only be paying de minimus transaction fees on ACH payments.

ROI

Let’s walk through an example where you aggressively adopt online payments; we’ll use round numbers so it’s easy to scale to your particular firm and assume that you expand the use of online payments to an additional $10M for the year:

That is an impressive increase in cash flow. However, we need to consider the cost. Most firms are paying all-in 3.2% to 3.4% (depending on the mix of credit card types) in fees. We offer a flat 2.95% rate, which is more common in the industry outside of legal, so we’ll use that number.

We’ll ignore the benefit of moving cash flow into the current year (as significant as that is!) and focus on the bottom-line numbers:

Client Experience

The client experience is an important component in achieving results like this in your firm:

- Payment links included in bill and A/R notice emails.

- A simple and elegant payment experience for your clients that includes remembering their contact and payment information.

- Autopay options so clients can choose to simplify their process and/or the firm can incorporate autopay requirements in engagement letters in appropriate circumstances. This can reduce the risk of taking on marginal credit clients.

- Consistent, professional A/R notices.

- Client portal where billing information is always available to clients.

Increasing your use of online payments is a win-win: it’s good for your clients and good for your firm.

How We Can Help

PayQ Law Firm Online Payments is a simple and elegant payment experience for both your accounting team and your clients. Key to making the numbers work is to make sure you’re not paying above-market rates. See the 2025 Law Firm Merchant Account Comparison for a deeper dive.