Quick Take

- Law firm finances are uniquely tied to the cycle of billing and collections, with the amount of unpaid work in WIP and A/R representing a firm’s total lockup.

- Workflow automation in a well-designed invoices-to-cash process has a notable impact on reducing lockup, increasing cash flow and collected realization rates.

- Business intelligence (BI) specifically tuned for billing and collections is an invaluable tool for tracking a firm’s progress against these key metrics.

Managing WIP and A/R Turnover in Law Firms

A primary focus in the law firms we work with is in reducing lockup. A high lockup means that a significant portion of the firm’s earnings is tied up in unbilled work and unpaid invoices, restricting liquidity and increasing financial risk.

The latest 2025 Citi Hildebrandt Client Advisory reveals that A/R and WIP grew by 14.2% and 11.1% in 2024 respectively, showing the continued struggle to convert work into cash efficiently.

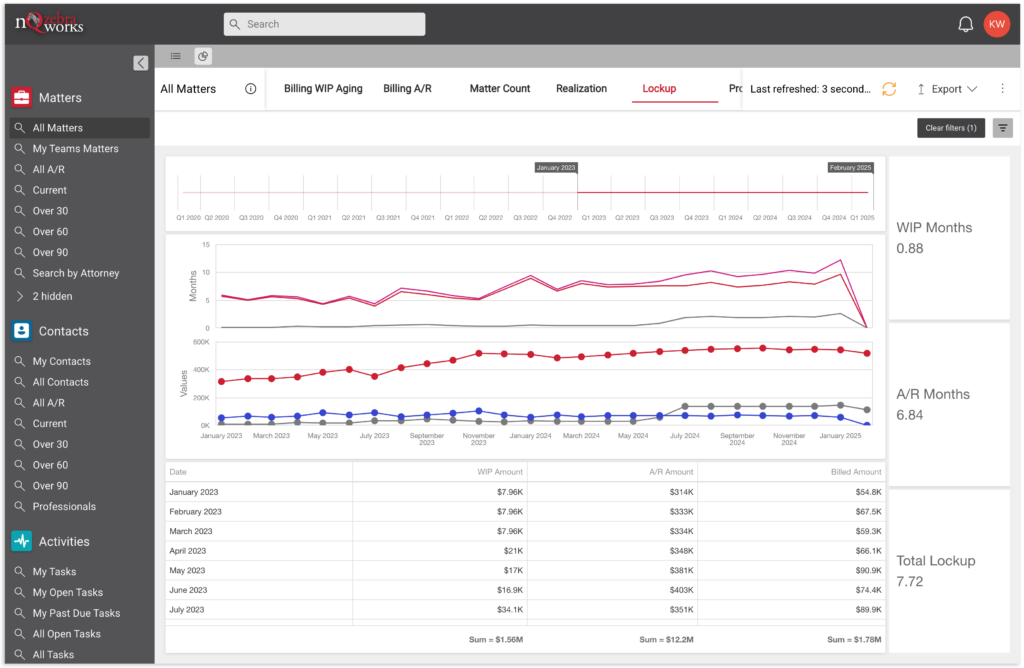

Understanding Turnover

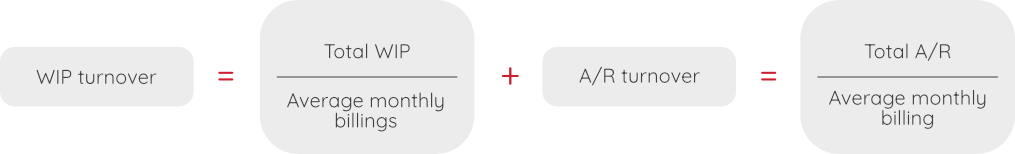

WIP turnover is the numbers of months billing you have in WIP, reflecting the speed at which unbilled worked is converted into invoices.

A/R turnover is how many months of billing you have in A/R, showing how long it takes you to convert invoices into payments.

Total Lockup is WIP turnover plus A/R turnover:

How Invoices-to-Cash Reduces Lockup

Bill Delivery

- Workflow automation dramatically speeds bill delivery

- Provides oversight and streamlines the process when billing attorneys are responsible for bill delivery

- Enables efficient final bill review as needed

RESULTS

Average reduction of 4-6 days in each billing cycle

A/R Notices and Central Follow-up

- Workflow automation applied to A/R follow-up increases throughput, driving collections

- Workflows enable efficient attorney-driven collections communication

- Keep everyone in the firm in the know by tracking all billing and collections activity in one central place

- Streamline the efforts of your collection professionals

RESULTS

Reduce A/R turnover by an average of 15 days

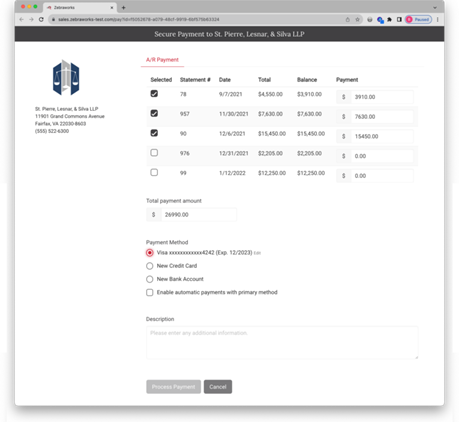

Client Portal

- Turning collections into a collaborative process where all outstanding invoices are always available to the client improves communication flow

- Remembering client payment preferences speeds the payment process

- Making it easier to pay, and you’ll get paid faster

RESULTS

Client portal and online payments drive an additional average reduction in A/R turnover of 30 days

Eliminate A/R

The most compelling strategy for reducing lockup is to not have A/R – at least in appropriate practice areas:

- Workflow automation to maintain evergreen trust accounts so that you’re always working against a retainer

- Require auto payments via credit card or eCheck/ACH in your engagement letter for appropriate practice areas or based on credit analysis; automatic payment capabilities in invoices-to-cash eliminate the manual hassles of this strategy

RESULTS

No Accounts Receivable for matters in these practice areas

Business Intelligence

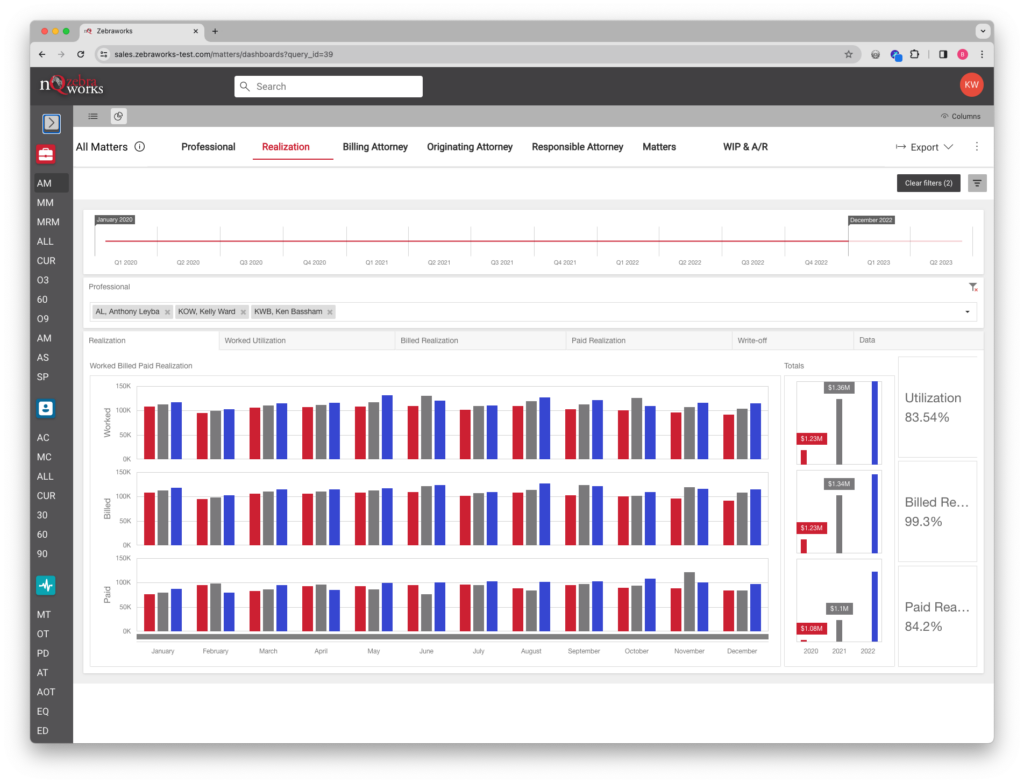

Business intelligence (BI) tools specifically designed for billing and collections play a crucial role in monitoring and improving key financial metrics:

- Monitor trends in lockup, invoice aging, and collections success rates

- Highlight which clients or practice areas have the slowest payment cycles, enabling targeted interventions

- Detect billing inefficiencies and unbilled time that may be slipping through the cracks

- Prioritize collections efforts

RESULTS

Insights drive data-driven decision making

The Financial Benefits of Reducing Lockup

- For every $10M in annual billing a 30 day reduction in lockup translates into $833,333 in additional cash flow

- Firms with lower lockup need less partner capital or external credit lines to sustain operations

- Faster collections reduce write-offs, increasing collected realization rates and net income

- Firms with low A/R turnover tend to have higher profit-per-partner ratios

How We Can Help

- Learn from other firms’ experience with legal invoices-to-cash case studies

- Learn more about the law firm invoices-to-cash solution, BillingQ

- We use the DataQ billing and collections BI built-in to our invoices-to-cash suite — demonstrated by the lockup dashboard above — to enable our firms to drive their analytics and evaluate performance

- PayQ, the law firm merchant account, not only cost-effectively processes online payments but streamlines the experience for your clients and your accounting team