Every law firm knows the story: Q4 hits, and suddenly the pressure is on to collect. Finance teams scramble. Partners hustle. Emails fly. Calls are made. All in the name of year-end collections.

December isn’t about the holidays in a law firm. It’s the final sprint to close out the fiscal year, get paid, and lock in profitability. But by then, it’s too late to fix the underlying issue: clients could have paid sooner.

If you want to win in Q4, the time to act is now.

The Q4 Collections Crunch

Every year, law firms face the same challenge:

- Cash flow targets must be hit by December 31st

- Realization rates are under scrutiny

- Distributions depend on it!

The last two months of the year become a mad dash to close the gap between work performed and cash collected. Yet the obstacles to payment are often self-inflicted:

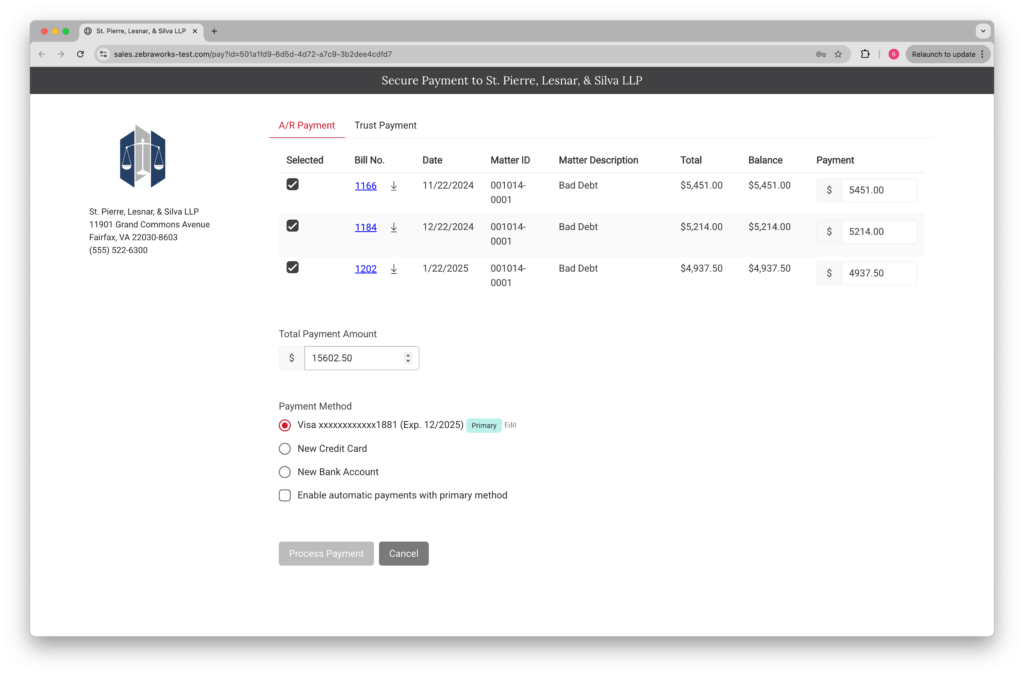

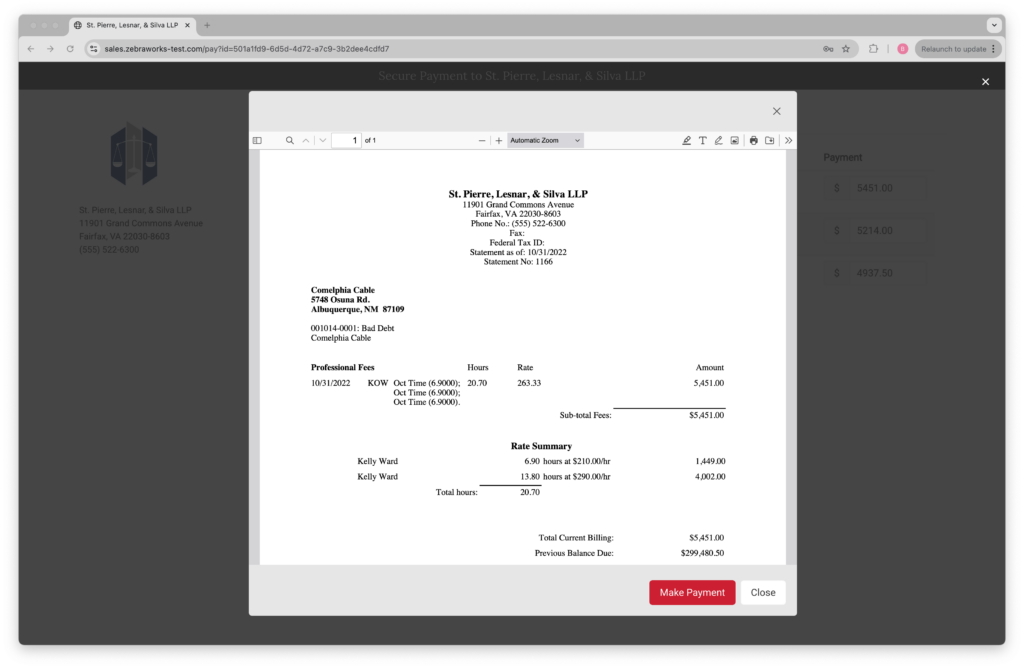

- Follow-up emails don’t include all the necessary information, e.g. full copies of bills with outstanding A/R

- Online payment options are missing or clunky

- Clients can’t see their bills when paying to verify information

Why Clients Don’t Pay (Even When They Can)

The easier we make it to pay, the more you will get paid. When clients are ready to pay, they still run into obstacles:

- They lose the bill or forget to act on it

- They can’t easily pay online

- They’re unsure what’s owed or for what, and don’t want to chase down answers

Now multiply those small delays across hundreds of clients, and you’ve got a Q4 headache.

The Client Portal Payoff

Implementing a secure, user-friendly client payment portal is one of the highest ROI moves a law firm can make in Q3. Why?

- Frictionless payments → faster collections

- 24/7 access → clients can pay on their own time

- Clarity → bill details and balances are visible and trackable

- Line-by-line reconciliation → speeds cash application

A client portal doesn’t just help in the long term—it pays off immediately in accelerating collections. But most importantly, it sets you up for success when it matters most: Q4.

In Q4, You’ll Wish You Had

By the time November rolls around, it’s too late to deploy a client portal and see the benefit by year-end. Now is the time!

Think of it this way:

- In Q4, you’ll be chasing dollars

- In Q3, you can change the outcome

Final Takeaway

Want to do fewer collection calls in December? Make it easier for your clients to pay in July.

Implementing a client payment portal today is how you ensure faster collections, higher realization rates, and a calmer Q4.

If you’re using a traditional payments provider currently, see our Law Firm Merchant Account Comparison to see how much better the online payment experience can be for both your clients and accounting team.

Because in Q4, this is what you’ll wish you had done now.